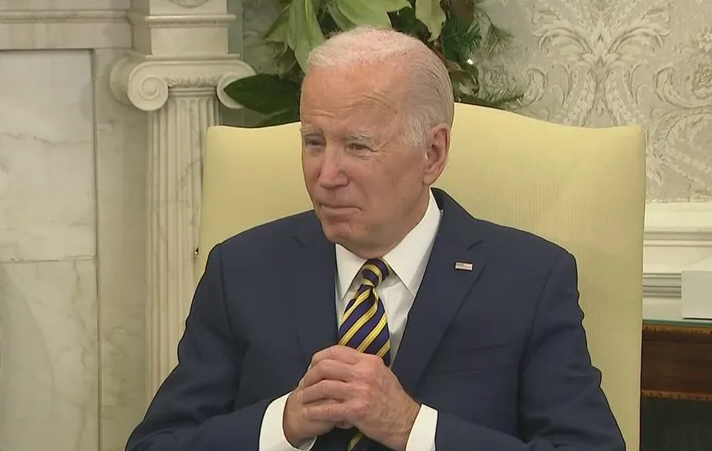

Jack Hellner writes for the American Thinker about legacy media outlets’ role in promoting President Biden’s misguided tax priorities.

The WSJ ran a recent article titled, “Biden Tax Plan’s Twin Challenges: Keeping his $400,000 Pledge and Paying for It”, and instead of reporting facts, author Richard Rubin focused on projections; here is one line, talking about President Trump’s 2017 tax reform laws: “When enacted the [Trump] tax law was estimated to cost $1.5 trillion over a decade. A recent study found it boosted growth but didn’t pay for itself.”

Somehow, the author decided not to report the facts so let’s look at the actual receipts since the law was passed. For the 2017 Fiscal Year, individual tax revenues yielded $1.6 trillion. …

… So in the first six years, individual tax revenues are up $2.2 trillion over the rate collected before the law was passed. …

… In the first six years after the law was passed, the government collected $174 billion more in corporate taxes.

So, in total, roughly $2.4 trillion more in additional taxes were collected post Trump’s tax rate cuts. And by the end of the decade, it appears that at least $3 trillion in additional revenues will be collected.

So how can anyone look at this data and make a definitive statement that the rate cuts didn’t pay for themselves? They can’t!

Joe Biden and others continue to lie that the tax rate cuts cost the government trillions; Rubin further states this: “Extending all expiring tax cuts would reduce federal revenue by about $4 trillion over a decade.”

How does anyone make a statement like that when revenues are rising with the current rates? Rising revenues don’t cause deficits—spending too much does.

Why would anyone propose raising rates when the lower rates increased revenues and growth? Here is a factual prediction: If the government confiscates more money for themselves from individuals and corporations, there will be less money to save, spend, and invest in the private sector. Growth will clearly be lower than it otherwise would be with a higher rate.