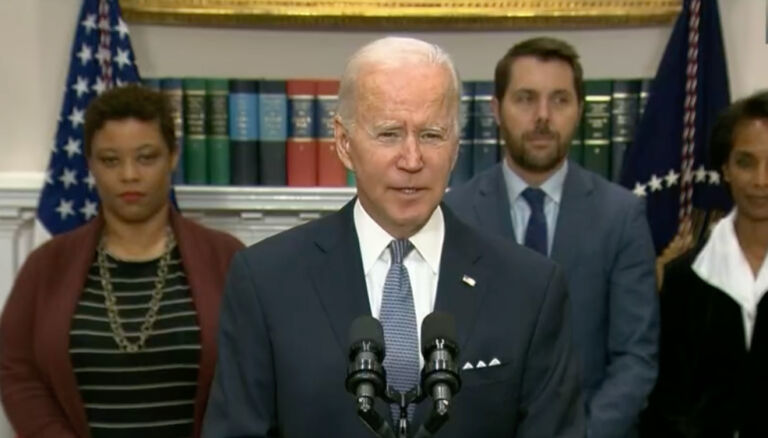

Haisten Willis of the Washington Examiner explores one economic factor that could challenge President Biden’s re-election bid.

The price of everything is up since 2020, but in absolute terms nothing has gone up more than mortgages.

With the 2024 presidential contest coming into focus, housing affordability will be among the economic issues at play, one that hits close to home in the American self-conception as a land of individual opportunity and prosperity.

GOP front-runner Donald Trump is sounding the alarm about threats to the American dream, penning an opinion piece that says things were better when he was in charge.

“When I was in office, the 30-year mortgage rate reached a record low of 2.65 percent — and the median-income American family could afford a mortgage,” Trump wrote in Newsweek. “Yet thanks to Biden’s disastrous economy, interest rates have skyrocketed, making home-ownership out of reach for too many Americans, especially young Americans who in previous generations would be looking to start a family.”

Mortgage rates remained low in the early months of the Joe Biden presidency, then began accelerating when the Federal Reserve raised interest rates to combat inflation. Mortgage rates have soared from around 3% at the start of last year to around 8% in recent weeks.

Each 1% rise in interest rates represents a payment increase of $5,000 annually on a $500,000 mortgage. Thus, a mortgage at that amount would cost $25,000 more each year now compared to early 2022.

Biden frequently talks up the economy, or “Bidenomics,” by pointing out strong GDP growth, low unemployment, strong manufacturing, and falling inflation rates since last summer. He has also focused on lowering consumer prices by battling “junk fees,” high gas prices, and especially student loan payments, yet speaks much less frequently on mortgage rates.

Democratic strategist Brad Bannon says that could be a mistake.